nj property tax relief for veterans

Reservists and National Guard personnel must be called to active duty service to qualify. An eligible Veterans Surviving Spouse or.

Nj Property Tax Relief Program Updates Access Wealth

Learn more about the New Jersey 100 Disabled Veterans Real Property Tax Exemption.

. Public Law 2019 chapter 203 extends the annual 250 property tax deduction to veterans or their surviving spousecivil uniondomestic partner who are residents of a continuing care retirement community CCRC. Military Personnel Veterans. 2022-03-08 To Assembly Military and Veterans Affairs Committee.

New Jersey has long provided a property tax deduction of 250 to some wartime veterans and their surviving spouses. These programs are managed by your local municipality. More veterans can get.

About the Company Property Tax Relief For Veterans In Nj. If you are a qualified Veteran Widow of a Veteran Senior Citizen Disabled Person or Surviving Spouse you may be eligible for deductions which reduce your property tax liability by 250. New Jersey voters gave a resounding yes to expand property tax benefits for veterans in last weeks election.

New Jersey Veteran 250 Property Tax Deduction. However the total of all property tax relief benefits that you receive for 2021 Senior Freeze Homestead Benefit Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the amount of your 2021 property taxes or rentsite fees constituting property taxes. See all New Jersey Veterans Benefits.

Voters are being asked whether more vets should be eligible. Surviving spouses may also qualify depending on circumstances. A ballot measure extending that deduction to peacetime veterans and their surviving spouses passed on November 3 2020.

Public Law 2019 chapter 413 became operative when New Jersey voters approved a Constitutional Amendment effective December 4 2020 to eliminate the wartime service requirement for both the 250 Veteran Property Tax Deduction and the Disabled Veteran Property Tax Exemption. The ballot question which passed with 76 of the vote makes veterans eligible for a 250 property tax deduction regardless of whether they served during a time of war or peace. A payment or a credit will be made by the CCRC to the claimant within 30 days after the CCRC receives its credited property tax bill.

Active military service property tax deferment. An 100 percent disabled veteran will receive a full property tax exemption. Under certain conditions combined deductions may be allowed ie.

New Jersey offers several property tax deductions exemptions and abatements. 100 disabled New Jersey veterans may be eligible for a 100 property tax exemption on their primary residence. 250 Property Tax Deduction for Senior Citizens and Disabled Persons.

Veteran property tax deduction. Effective December 4 2020 State law PL. Effective December 4 2020 State law PL.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. 250 Veteran Property Tax Deduction. Allows property tax rebate for disabled veterans.

413 eliminates the wartime service requirement for the 250 Veterans Property Tax Deduction. Honorably discharged Veterans from active duty service in the US. 6000 Veteran Income Tax Exemption Military veterans who were honorably discharged or released under honorable circumstances are eligible for a 6000 exemption on New Jersey Income Tax returns.

100 Disabled Veteran Property Tax Exemption. 2022-03-14 To Assembly Military and Veterans Affairs Committee. 413 eliminates the wartime service requirement for the 100 Totally and Permanently Disabled Veterans Property Tax Exemption.

A disabled veteran in New Jersey may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent disabled as a result of wartime service. CuraDebt is a company that provides debt relief from Hollywood Florida. To receive the 25000 property tax deduction for a Veteran or Surviving SpouseDomestic Partner of Veteran or Service Person the person must make application and meet the following qualifications by October 1 of the pre-tax year the year prior to when you are applying.

Veterans must have active duty service with an honorable discharge. It was founded in 2000 and has since become a member of the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators. New Jersey Property Tax Reduction Through Exemptions and Deductions.

Nj property tax relief for veterans Thursday March 17 2022 Edit 17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider. Active duty for training continues to be ineligible. Armed Forces may qualify for an annual 250 property tax exemption on their primary residence.

More than 57000 veterans will soon be eligible for help paying their property taxes after New Jersey voters on Tuesday appeared to overwhelmingly support a change to the state constitution. Reservists and National Guard personnel must be called to active duty service to qualify. 250 Veteran Property Tax Deduction.

There are four main tax exemptions we will get into in detail. If you are an. 100 Disabled Veteran Property Tax Exemption.

Aside from tax relief programs you may be eligible for property tax exemptions in NJ. Designates April 13th as Borinqueneers Day in New Jersey. 100 disabled veteran property tax exemption.

It also expands a property tax exemption to include totally. NJs wartime military veterans who own a home can receive a 250 deduction in property taxes. Tax deductions exemption and deferment programs include.

Active Military Service Property Tax Deferment. The 100 property tax exemption for disabled veterans is applicable only to taxes paid on a primary residence. Veterans New Jersey Property Tax Deduction and Exemption Extended to Peacetime Veterans.

Veterans must have active duty military service with an honorable discharge. Both Veterans and Senior Citizens.

Tax Trivia If You Own A Tv In England You Pay An Annual Television Tax But If You Re Blind You Ll Only Need To Pay Half Tu Trivia Tuesday Family Fun Trivia

Wisconsin Medical Records Release Form Download Free Printable Blank Legal Medical Record Release Form Te Medical Records Protected Health Information Medical

Disabled Veterans Property Tax Exemptions By State

National Insurance Claim Form For Mediclaim Here S Why You Should Attend National Insurance National Insurance Insurance Claim National

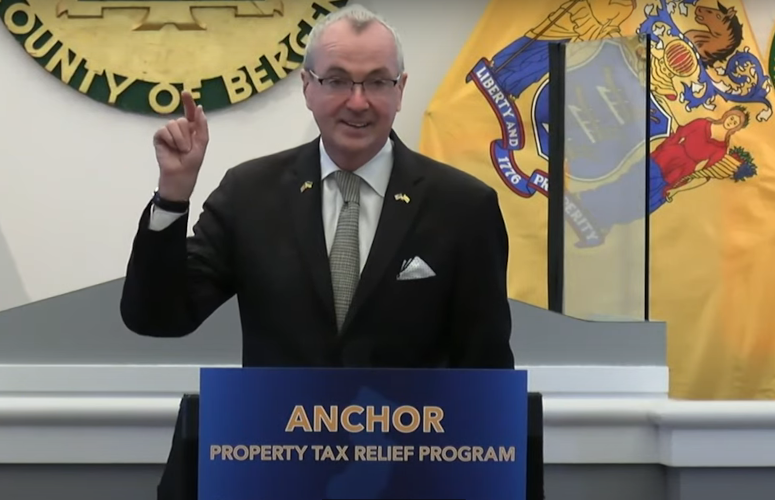

Murphy Proposes 900m Anchor Property Tax Relief Program New Jersey Business Magazine

Regrann From Thebrokeagent Be Honest Or You Can Reduce Your Contingency Period Again That Will Look Great Aga Realtor Humor Real Estate Humor New Jersey

The Single Biggest Difference Between Financial Success And Financial Failure Is How Well You Manage Financial Literacy Financial Motivation Financial Quotes

A Plus Cool A Frame Makes The Grade As This Week S Most Popular Home Real Estate Nj Real Estate Houses Bank Owned Homes

These Are The Cities Where Workers Are Getting Priced Out Of The Housing Market House Prices Chart Growth

Your Odds Of Facing An Irs Audit Are 1 In 143 Kids Calendar Irs Debt Relief Programs

Pin On Legal Form Template Waiver Download

Auto Insurance Nj Cheapest 2021 Car Insurance Best Car Insurance Affordable Car Insurance

Indiana Medical Records Release Form Download Free Printable Blank Legal Medical Record Release Form Template Or Waiver In Dif Medical Records Records Medical

Wyoming Decree Of Divorce With Children Form Divorce Forms Divorce And Kids Divorce

These 10 Towns Have The Highest Nj Property Taxes Https Www App Com Story News Investigations Data 2017 07 31 Highest Property Taxe Property Tax Tax Property

Watch Mail For Debit Card Stimulus Payment Prepaid Debit Cards Debit Card Visa Debit Card

Atlantic City History Google Search Monopoly Atlantic City The Real World

5 Mistakes To Avoid While Refinancing Mortgage Ladder Kerala Calicut Refinancing Mortgage Mortgage Rates Mortgage Payoff